The Best Strategy To Use For Clark Wealth Partners

Wiki Article

Not known Factual Statements About Clark Wealth Partners

Table of ContentsClark Wealth Partners for DummiesThings about Clark Wealth PartnersClark Wealth Partners for DummiesNot known Details About Clark Wealth Partners More About Clark Wealth PartnersNot known Factual Statements About Clark Wealth Partners Clark Wealth Partners for BeginnersThe Basic Principles Of Clark Wealth Partners

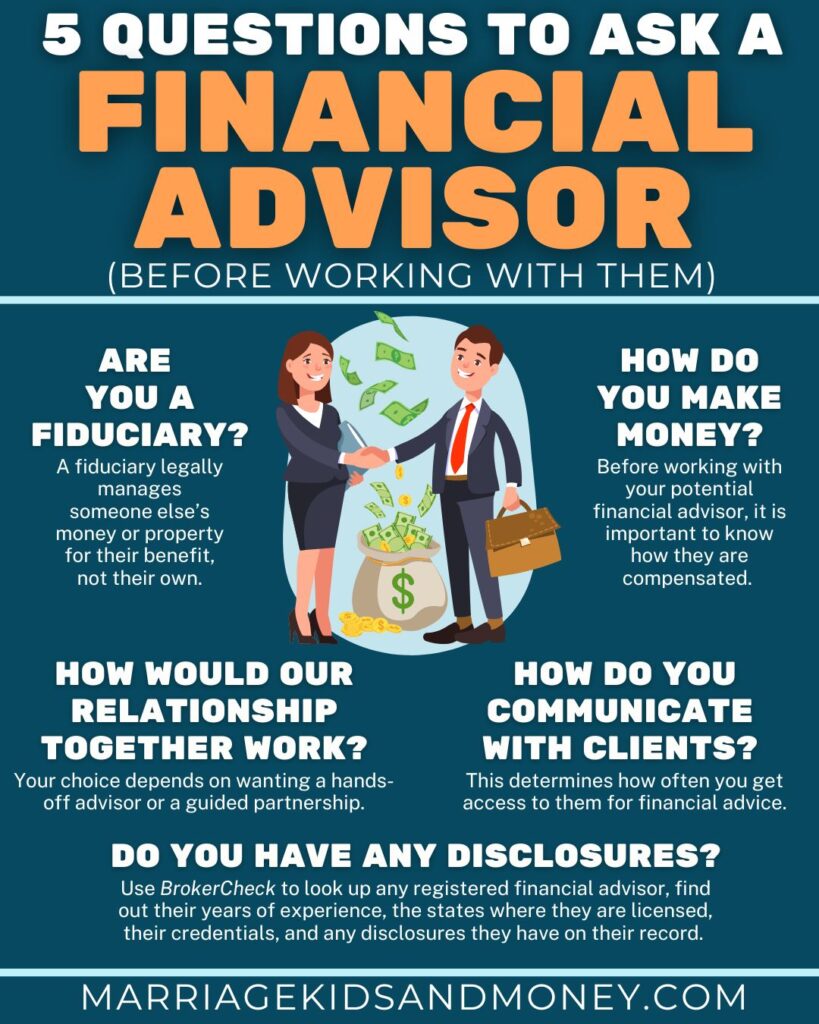

Common reasons to consider a monetary expert are: If your financial situation has become extra intricate, or you do not have confidence in your money-managing skills. Conserving or browsing significant life events like marriage, separation, children, inheritance, or task modification that might dramatically impact your financial circumstance. Navigating the transition from conserving for retired life to protecting wealth during retirement and how to create a strong retirement earnings plan.New innovation has actually resulted in even more extensive automated economic devices, like robo-advisors. It's up to you to examine and identify the right fit - https://disqus.com/by/blancarush/about/. Ultimately, a great economic advisor must be as mindful of your financial investments as they are with their own, preventing too much charges, conserving cash on tax obligations, and being as clear as feasible concerning your gains and losses

All About Clark Wealth Partners

Gaining a payment on product referrals does not always indicate your fee-based advisor functions against your benefits. Yet they may be a lot more likely to recommend product or services on which they gain a commission, which might or might not remain in your ideal passion. A fiduciary is legitimately bound to put their client's rate of interests initially.They might comply with a loosely kept an eye on "viability" criterion if they're not registered fiduciaries. This conventional permits them to make referrals for financial investments and solutions as long as they match their customer's objectives, risk tolerance, and financial circumstance. This can convert to suggestions that will certainly likewise earn them cash. On the various other hand, fiduciary consultants are legitimately bound to act in their client's finest rate of interest as opposed to their own.

About Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving right into complicated financial topics, dropping light on lesser-known investment avenues, and uncovering ways viewers can function the system to their advantage. As an individual finance professional in her 20s, Tessa is really familiar with the impacts time and uncertainty have on your financial investment choices.

It was a targeted ad, and it worked. Read a lot more Read much less.

Some Ideas on Clark Wealth Partners You Should Know

There's no single path to becoming one, with some people starting in banking or insurance, while others start in accountancy. 1Most economic planners begin with site link a bachelor's degree in money, economics, audit, organization, or an associated subject. A four-year degree gives a solid structure for jobs in investments, budgeting, and customer services.

The Single Strategy To Use For Clark Wealth Partners

Common examples include the FINRA Collection 7 and Series 65 examinations for securities, or a state-issued insurance certificate for offering life or wellness insurance. While qualifications might not be legally required for all preparing roles, companies and customers often view them as a standard of professionalism. We consider optional qualifications in the following section.Many monetary planners have 1-3 years of experience and knowledge with financial products, compliance criteria, and straight customer communication. A strong educational background is necessary, however experience demonstrates the capacity to apply theory in real-world settings. Some programs incorporate both, enabling you to finish coursework while making monitored hours with teaching fellowships and practicums.

Rumored Buzz on Clark Wealth Partners

Several enter the field after working in banking, accountancy, or insurance coverage, and the change requires persistence, networking, and frequently advanced qualifications. Very early years can bring lengthy hours, pressure to develop a customer base, and the demand to constantly prove your know-how. Still, the profession offers strong long-lasting potential. Financial coordinators enjoy the opportunity to work very closely with customers, overview important life choices, and often attain adaptability in routines or self-employment.

They spent less time on the client-facing side of the market. Nearly all monetary supervisors hold a bachelor's degree, and lots of have an MBA or similar graduate degree.

The 30-Second Trick For Clark Wealth Partners

Optional accreditations, such as the CFP, usually call for added coursework and testing, which can prolong the timeline by a number of years. According to the Bureau of Labor Data, individual monetary advisors earn a typical annual annual income of $102,140, with leading income earners making over $239,000.In other districts, there are laws that require them to fulfill particular needs to make use of the monetary advisor or financial planner titles. For economic organizers, there are 3 typical designations: Certified, Personal and Registered Financial Organizer.

Getting My Clark Wealth Partners To Work

Where to discover an economic consultant will depend on the kind of suggestions you need. These establishments have personnel who might help you comprehend and get specific types of financial investments.Report this wiki page